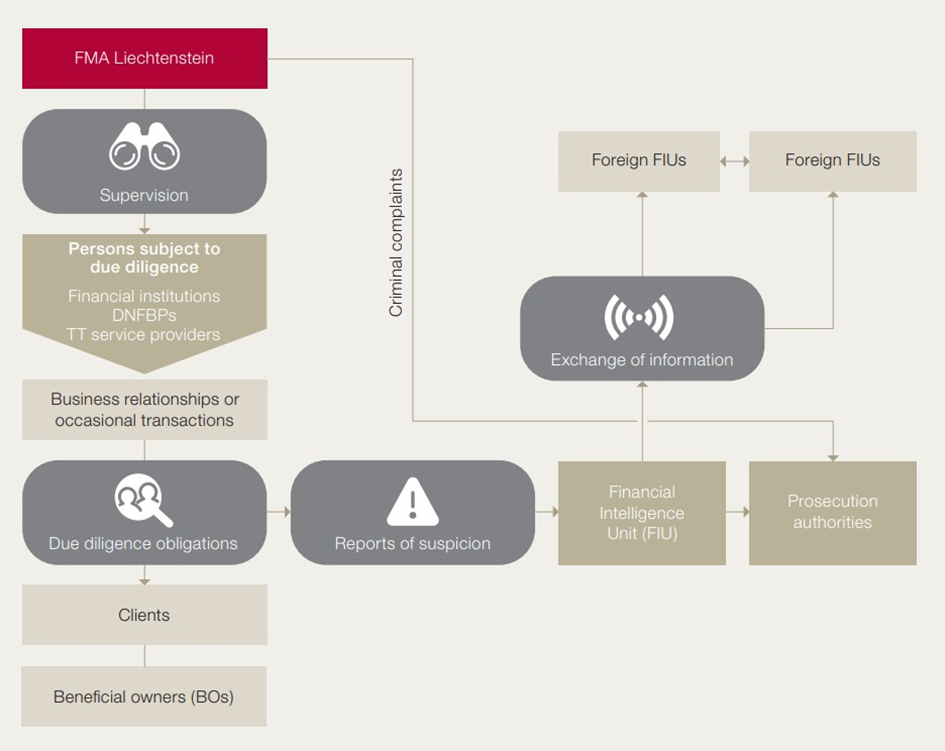

Persons subject to due diligence

Financial institutions, TT service providers, and DNFBPs must comply with anti-money laundering rules when dealing with their clients. These due diligence obligations are laid down in the Due Diligence Act (SPG) mentioned above and in various implementing regulations.

The most important due diligence obligations

- Identification and verification of clients

- Identification and verification of beneficial owners

- Clarification of clients' source of funds and source of wealth

- Ongoing transaction monitoring

- Filing of reports of suspicion of money laundering, predicate offences of money laundering, or financing of terrorism

Financial Intelligence Unit (FIU)

The FIU is responsible for receiving and analysing reports of suspicion from persons subject to due diligence and public authorities. Where it suspects that a criminal offence has been committed, the FIU reports to the Office of the Public Prosecutor. The FIU also analyses general threats of money laundering, predicate offenses of money laundering, and financing of terrorism.

Prosecution authorities

The Office of the Public Prosecutor examines the FIU's analysis reports and initiates investigations where appropriate. If there is sufficient suspicion of an offence, it files charges with the competent court. The prosecution authorities are responsible for enforcement of the Criminal Code (money laundering and predicate offences, financing of terrorism) and parts of the SPG (e.g. reports of suspicion filed late or not at all).

Office of Justice

The Act on the Register of the Beneficial Owners of Legal Entities (VwbPG) was enacted to transpose the requirements of the Anti-Money Laundering Directives governing registers of beneficial owners of entities. This register with information on the beneficial owners of Liechtenstein companies, foundations, and trusts is maintained by the Office of Justice.

Compliance with international standards

Liechtenstein has been participating actively in AML/CFT efforts for decades, guided by the international standards of the Financial Action Task Force (FATF). Since 1999, Liechtenstein has been a member of MONEYVAL, an FATF-style regional body, which is based at the Council of Europe in Strasbourg (35 member jurisdictions). MONEYVAL is an associate member of the FATF and reports regularly to the FATF.

Like the FATF, MONEYVAL regularly reviews the quality of the national regulations implementing the 40 FATF Recommendations among its member jurisdictions and evaluates the effectiveness of the national AML/CFT systems. In 2021/2022, implementation of the FATF Recommendations in Liechtenstein was reviewed by MONEYVAL as part of its fifth round of evaluations (corresponding to the fourth round of evaluations by the FATF).

MONEYVAL published its fifth report on Liechtenstein on 29 June 2022:

The report shows that Liechtenstein has a broad and convergent understanding of its money laundering and terrorist financing risks and that it pursues a strong supervisory approach commensurate to the risks.

Liechtenstein performed very well in comparison with the other countries already evaluated and, as a result of the positive report, will be subject to the regular MONEYVAL follow-up process (as opposed to the enhanced process). Liechtenstein is one of only five member jurisdictions with this result. MONEYVAL also emphasised Liechtenstein's progress since the fourth round of evaluations and encourages the country to further intensify its AML/CFT measures.

With regard to its AML/CFT laws, ordinances, and guidance, Liechtenstein was rated "compliant" or "largely compliant" with 37 of the 40 recommendations (no ratings of "non-compliant"). In assessing the effective application of legal regulations in practice, Liechtenstein scored above average in five of 11 "immediate outcomes" examined. MONEYVAL did not identify any significant gaps in Liechtenstein's AML/CFT measures in the other areas evaluated.

Cooperation at the European level

At the EU/EEA level, AML/CFT responsibilities relating to the financial market have been centralised at the European Banking Authority (EBA). The AML CFT Standing Committee (AMLSC), composed of high-level representatives of the national supervisory authorities, was created to fulfil these tasks. The AMLSC develops regulatory technical standards (RTSs) and guidelines in accordance with the requirements of the 4th and 5th EU Anti-Money Laundering Directives and Regulation (EU) 2015/847. The AMLSC also meets at regular intervals to coordinate and harmonise the work of the national supervisory authorities and to exchange information on current developments in the member countries. The FMA represents Liechtenstein in the AMLSC as a non-voting member.